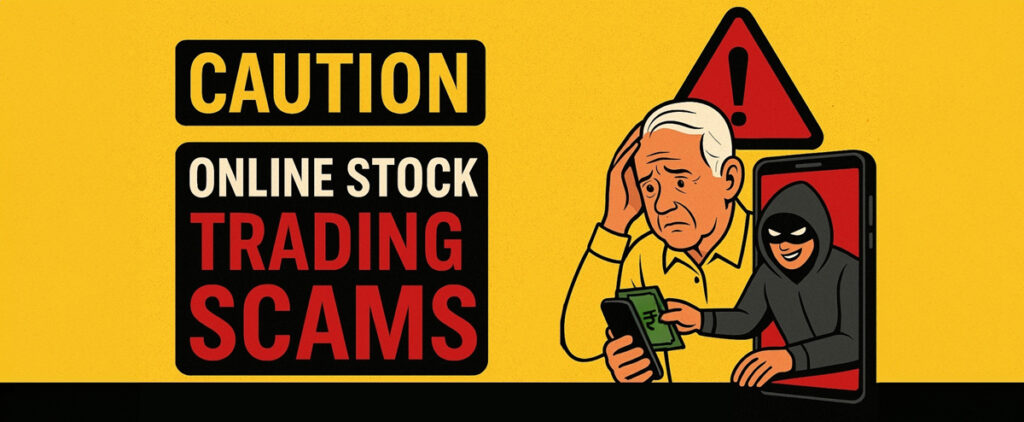

A 75-year-old senior citizen hailing from Colaba, Mumbai recently lost ₹11.1 crore to cyber fraudsters in a fake share trading scam. The fraudsters promised high returns through a trading app, slowly building trust. Over several months,

the man kept investing, believing his profits were growing; until he realised he couldn’t withdraw any money. By then, it was too late.

Sadly, this is not a rare case.

A retired woman received a call claiming a parcel in her name containing illegal items was stuck in Taiwan. She was told she’d be arrested if she didn’t cooperate. The scammer posed as a cop and put her under ‘digital arrest’, asking her to transfer money for “verification” of her identity and innocence. Over time, she sent ₹3.8 crore to various accounts. She only realised it was a scam when her daughter intervened. By then, it was almost too late.

This “digital arrest” scam is becoming alarmingly common. Scammers pose as police or government officials, telling victims they’re under investigation and must remain isolated, completely cut off from others. During this time, they pressure victims to send money for “investigation costs,” “clearance fees,” or “bail.”

Across India, more and more senior citizens are falling victim to such online frauds. The reason? Many elderly Indians, not born into the digital age, are now using smartphones, banking apps, and social media. While this brings convenience, it also makes them easy targets for fraud.

How Cybercriminals Target Seniors

Some common tactics include:

- Scare calls from fake police or courier companies.

- Lottery or prize messages that ask for fees.

- Fake investment offers promising huge returns.

- Romance scams that play on loneliness.

- Phishing emails that steal passwords or bank info.

Tips to Protect Yourself

- Don’t Trust Unknown Calls: If someone calls claiming to be from a bank, police, or courier service, and asks for money, hang up immediately. Real authorities do not demand money over the phone, or otherwise.

- Ignore Unknown Links and Emails: Never click on links in messages or emails from unknown senders. They may lead to fake websites or install viruses on your phone.

- Use Strong Passwords: Avoid easy passwords like “12345” or your birthday. Use a password only you can remember.

- Enable Two-Factor Authentication (2FA): This adds an extra layer of security. Even if someone gets your password, they can’t log in without the second code sent to your phone.

- Update Phones and Apps Regularly: Many seniors use old phones or avoid updates. But updates fix security holes, so make sure all devices are up to date.

- Limit Sharing on Social Media: Avoid posting personal information like birthdays, family details, or location. Scammers use this to guess passwords or build fake stories to lure you in with sob stories to later swindle you or manipulate you into giving them money.

For Caregivers: What You Can Do

- Start the Conversation: Talk openly with your parents or grandparents about scams. Share real stories. Make them comfortable asking questions.

- Do a Device Check-Up: Check their phones, laptops, tablets. Make sure everything has antivirus software and is password protected.

- Use the 1930 Helpline: If you suspect fraud, call 1930 immediately. It's India’s cybercrime helpline. The sooner you act, the better the chance to recover money.

- Add Trusted Contacts: Set up a trusted contact for bank accounts. This helps banks flag unusual activity and alert someone reliable.

- Block Unknown Numbers and Spam: Help your elders learn how to block calls and report spam on WhatsApp and email.

Our elders took care of us and now it’s our turn. Online fraud is growing fast, but awareness can stop it in its tracks.

Elders

Elders