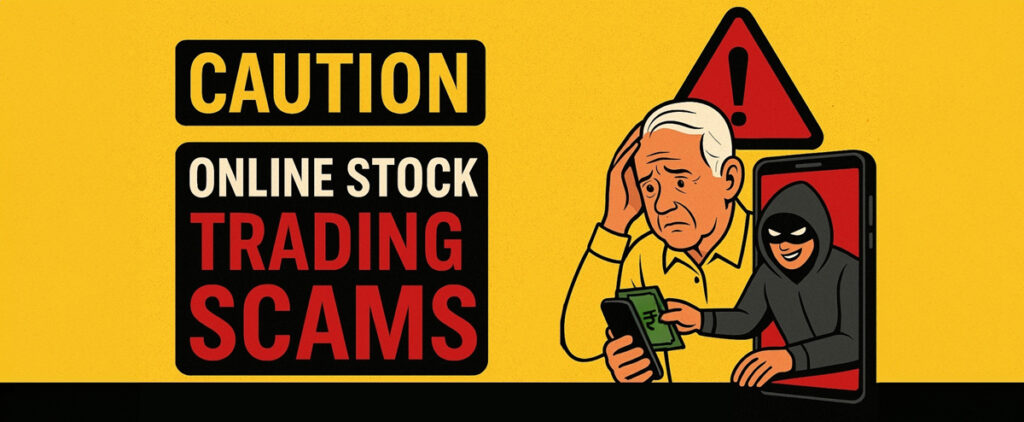

R ecently in Noida, a senior citizen in her 60s fell victim to a money transfer scam. The con artist, posing as one of her husband's clients, persuaded her to complete a nearly ₹50,000 transfer. By the time she discovered it was a scam,

the transfer was complete and the scammer’s phone number was already disconnected and deactivated.

This is not an isolated incident. As digital banking continues to increase, more con artists are targeting senior citizens who are financially stable but might be uncomfortable utilizing fast-changing digital banking platforms, or not being up-to-date with fraud tactics.

But this doesn’t mean you have to avoid online banking.

Using online banking has advantages; it being quick, easy, and always available. No more waiting in long queues at the bank. From checking your balance to paying bills, everything can be done from the comfort of your home.

If you take the right precautions, you can enjoy its advantages securely.

Here’s a quick guide to protect your money online.

- Use Strong, Unique Passwords: Your password is your first line of defence. Use a mix of letters, numbers, and special characters. Don’t use your name, birthdate, or “123456”. Avoid using the same password for multiple accounts. Change your password regularly.

- Never Share Your Password or OTP: No bank or bank staff will ever call or message you asking for your password, PIN, or OTP. If someone does, it’s a scam. Hang up immediately. Always keep this information private, even from friends or family.

- Beware of Fake Emails and Messages: Scammers often send messages that look like they’re from your bank. These may ask you to click a link or share your details. Don’t do it. Always ask your bank if they sent you an email. Verify first, because if something looks fishy, it probably is.

- Don’t Trust Strangers on the Phone: If someone calls you claiming to be from the bank, don’t trust them blindly. Always verify. Call the bank’s toll-free number and confirm. Never transfer money or share account details unless you are 100% sure.

- Avoid Public WiFi for Banking: Do you use free WiFi at malls, airports, or restaurants? Don’t use it to log into your bank account. Public WiFi is not safe. Hackers can steal your login information. Use your mobile data or home WiFi for banking.

- Enable SMS and Email Alerts: Enable notifications and alerts for every transaction. This way, you’ll know immediately if money goes in or out of your account. If you see something wrong, report it to the bank right away.

- Log Out After Use: When you’re done with internet banking, log out completely. Don’t just close the tab or app. Always log out properly to keep your account safe.

- Install Antivirus Software: Be careful not to download apps or email attachments from unknown sources. You can get viruses on your phone and computer that can steal the passwords and personal information on your devices. Use reliable antivirus software and keep it updated.

- Use Two-Factor Authentication (2FA): Most banks offer 2FA. This means you need a password and an OTP to log in. It’s like having a double lock on your door. Always, turn this feature on if your bank provides it.

- Check Your Bank Statements Often: Make it a habit to go through your account statement every month. Look out for anything suspicious. If you find a transaction you never made, contact your bank immediately.

We understand that learning a new technology may feel overwhelming at times and that’s okay. You do not have to learn it all at once. Next time you do not understand something, ask: your children, grandchildren, bank staff. There is no shame in being careful with your money; the money that you worked your entire life for. Let a family member, friend, or the manager of the bank help you.

Elders

Elders