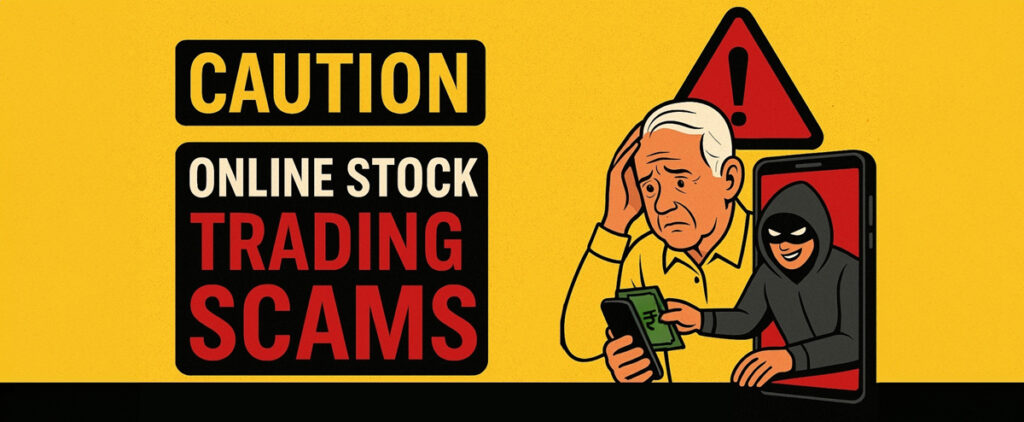

I n December 2024, 73-year-old Sasidharan Nambiar, a retired Kerala High Court judge, joined a WhatsApp group named “Adithya Birla Equity Learning.” He thought it was a stock market discussion group. Within days, group members

promised 850% profit on investments. Trusting the group, Nambiar invested over ₹90 lakh. The money vanished. So did the scammers.

Earlier in 2023, Rajesh, a businessman from Cherthala, lost over ₹7 crore in a similar scam. He was added to a group called “Dalal Street Traders.” It looked legitimate, with daily updates and fake financial advisors. He too believed he was making smart investments. But when he tried to withdraw the profits, there was silence.

These are not one-off cases. The Indian Cyber Crime Coordination Centre found ₹120 crore was lost to investment fraud in the first three months of 2024, with more than 81,000 fake groups being found on WhatsApp alone. Scams today knock on your door via WhatsApp, Facebook, Emails, and SMS. Scammers impersonate some of the most recognizable brands, such as SBI, Aditya Birla, or HDFC, to entice you with big returns on Stocks, Mutual Funds, or even Cryptocurrencies.

So, what are some common tricks used by these scammers?

- Too-Good-To-Be-True Returns: “Invest ₹1 lakh, get ₹10 lakh in 30 days!” - Sounds exciting, but no real investment can guarantee this. If someone promises big returns with zero risk, it’s likely a scam.

- Fake Company Names: They use names that sound like well-known firms. They even create fake websites and IDs. Always double-check the spelling and look up the company on the official SEBI or RBI website.

- High Pressure to Act Fast: Scammers create urgency so you don’t get time to think. A genuine advisor will never rush you.

- Unsolicited WhatsApp Groups or Calls: If you get added to a group or receive a call from a stranger with an investment idea, be alert. Most scams begin this way.

- Small Initial Gains: Some scammers give small returns initially to build trust. Then they convince you to invest more, once you agree, they disappear with your money.

How to Protect Yourself

- Don’t share OTPs, bank passwords, or PINs - Even with people claiming to be from the bank. No real bank will ask for these.

- Don’t click on suspicious links - Never click on unknown links sent through WhatsApp or email. They could lead to fake websites or steal your data.

- Verify before you invest - Use the SEBI website (www.sebi.gov.in) to check if the investment company or advisor is registered.

- Talk to your family or a trusted financial advisor - If you’re unsure, always ask someone you trust before investing.

- Report any suspicious activity - If you feel you’ve been targeted, report it immediately at www.cybercrime.gov.in or at your nearest police station.

As India grows from a nation that saves to one that invests, it is only normal for more retirees to review the ways they are able to grow their savings. This shift is empowering, but it is also risky for our senior citizens. If you’ve spent a lifetime building savings carefully, it is normal to expect you will be able to invest confidently. The good news is that a little caution and awareness can help you be protected from possible scams, and help you make safe investment choices!

Elders

Elders