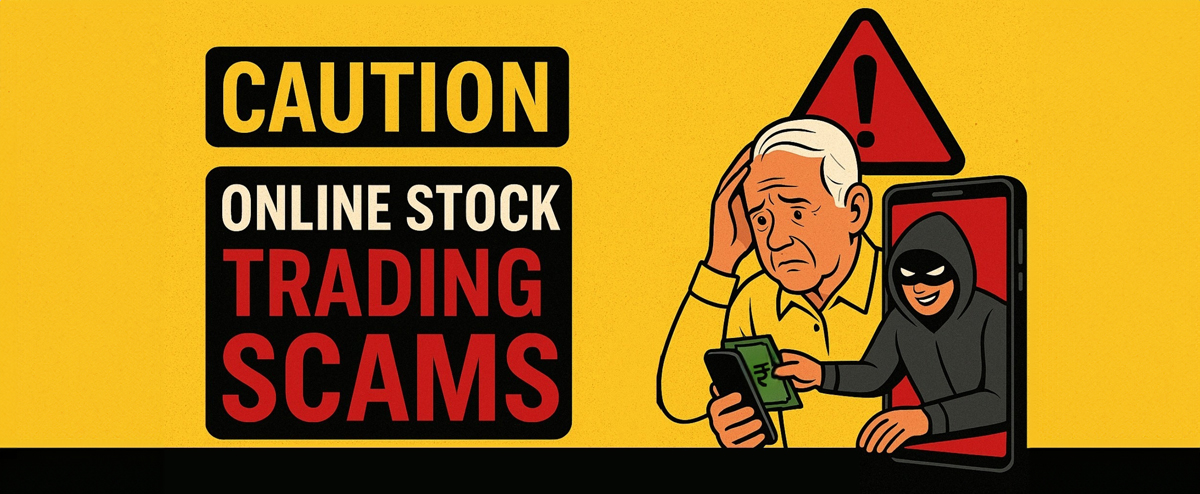

A s we grow older, financial security becomes even more important. Many senior citizens look for ways to grow their savings, and since investing has become easier than ever thanks to technology, online stock trading seems like an

appealing choice. But watch out—scammers are capitalizing on this same convenience to dupe naive investors, especially retirees who may not be as familiar with digital security.

Take the case of a 67-year-old entrepreneur from Pune, who lost a whopping Rs 1.86 crore in an online trading scam. Worse yet, he was led to believe that his investment had increased to Rs 54 crore—until it was too late.

The Trap: How It All Began

One day, while scrolling through his phone, this senior businessman came across an online advertisement for a stock trading platform that promised huge returns. With decades of experience in running a manufacturing business, he thought he understood investments. Clicking on the link, he was soon added to a WhatsApp group filled with over 130 members, all sharing stories of their ‘big profits.’

For two weeks, he carefully observed. The group seemed genuine, with people enthusiastically sharing their earnings. The two administrators regularly posted stock tips, reinforcing the illusion of credibility.

Subsequently, one of the administrators directly contacted him, inviting him to join an exclusive mobile trading application. Convinced by the buzz in the WhatsApp group, he proceeded accordingly.

The Fake Trading App

The app looked professional. He registered by submitting his details and began making investments, following the advice of the group admins. Every transaction reflected on the app, showing impressive profits. Within just 20 days, his Rs 1.86 crore investment was displayed as Rs 54 crore.

Everything seemed perfect, and then he tried to withdraw some of his money.

The Reality Check

When he requested a withdrawal, he was asked to pay a 20% ‘service charge’—amounting to Rs 10.8 crore before he could access his supposed earnings. This was when the first doubts crept in.

He tried reaching the group administrators, but they stopped responding. The once-active WhatsApp group fell silent. He then realized he had been scammed and rushed to the Pune Cyber Crime Police Station, but by then, the money was gone.

The Bigger Picture

Unfortunately, this is not an isolated incident. Over the past year, Pune and Pimpri Chinchwad police have recorded a surge in online stock trading scams, with more than 128 cases involving fraud amounts exceeding Rs 50 lakh each. Collectively, victims have lost a staggering Rs 143 crore.

Fraudsters create a fake sense of credibility using WhatsApp groups, social media, and even virtual seminars. After earning a victim’s trust, they encourage them to download rogue trading apps and invest significantly. The victims see fake profits, which encourages them to invest even more. But when they try to cash out, the fraudsters vanish.

Why Senior Citizens Are Targeted

Scammers know that many seniors:

- May not be as tech-savvy and unfamiliar with online fraud techniques.

- Have retirement savings that make them appealing targets.

- Are trusting and more likely to believe online communities that appear friendly and helpful.

- May hesitate to seek help out of embarrassment or fear of being judged.

How to Stay Safe from Such Scams

If you or someone you know is interested in investing online, keep these precautions in mind:

- Verify Before You Trust: Always check if a trading platform is registered with SEBI (Securities and Exchange Board of India). Do not trust advertisements or WhatsApp groups blindly.

- Be Wary of Strangers Offering Financial Advice: If someone approaches you online with investment tips, be sceptical. Legitimate financial advisors do not randomly message people in group chats.

- Never Transfer Money to Personal Accounts: A legitimate investment company will never ask you to send money to an individual’s bank account.

- Avoid ‘Too-Good-To-Be-True’ Offers: If an investment claims to double or triple your money in a short time, it is likely a scam.

- Talk to Family or Trusted Advisors: Before making any financial decision, consult your children, relatives, or a trusted financial expert.

- Stay Updated on Cyber Threats: Cybercrime agencies frequently release warnings on new scams. Keep yourself informed through trusted news sources.

If it appears too good to be true, stop and check before taking action. Remember, fraudsters prey on trust, but awareness is the best defense to stay safe. Be vigilant, ask questions, and always verify before investing online. A moment of caution can protect you from a lifetime of regret.

Elders

Elders