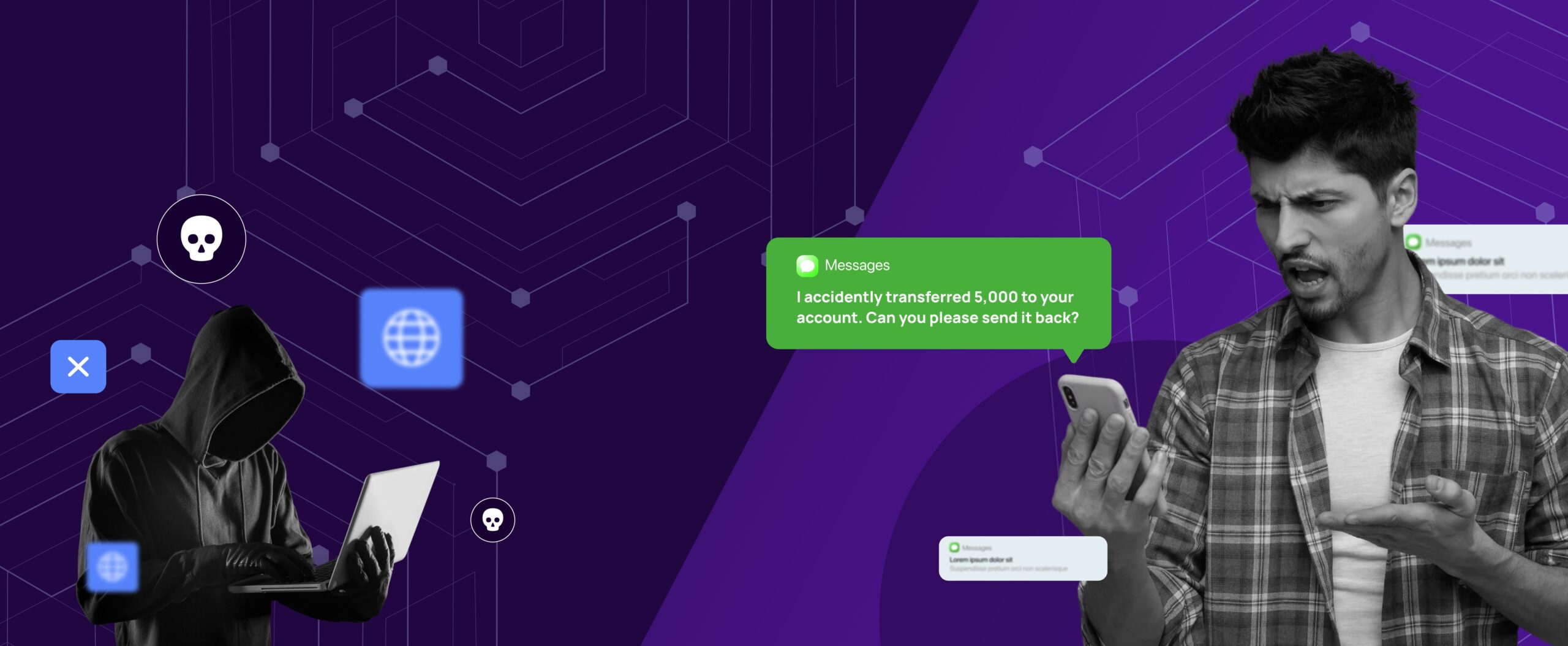

I magine this. You get a message or call from an unknown number. They claim that they accidentally transferred money to you. They share a payment screenshot, and you even receive an SMS stating that the amount has been credited to your account.

The person on the other end says it’s an emergency and they need the money. Believing the other person and wanting to help them, you transfer the amount.

A few hours later, you check your balance and it’s much lower than you expected. You call the person, who does not respond. By now, you realize that you have been duped and it’s too late.

Incidents like this have happened to countless people all over India. By taking advantage of people’s lack of attention and desire to help, scammers are making fortunes through this internet fraud.

How The Scam Works

This payment fraud is executed in many different ways, but the basic premise remains the same. The objective is to convince unsuspecting people that they have accidentally received money which is requested to be returned.

- Fake Payment Screenshot: The scammer sends you a screenshot showing that money has been transferred to your account. It looks genuine and like it’s from a legit app. But the screenshot is often an altered one. Mistaking this as official proof, people give the money.

- Fake SMS: An SMS often comes showing that money has been credited to your account. The SMS though, is from an unknown number and not from the bank. The pressure from the scammer, who often calls repeatedly, causes many people to overlook this and transfer the money.

- Repeated Phone Calls: The scammer calls their victim repeatedly, especially if they don’t answer. This makes it seem like there’s a genuine emergency and also disorients them, due to which they impulsively make a payment.

- Malicious QR Code: The scammer often sends their victim a QR code to scan and insists they pay the money through that. Upon making the payment, a far greater amount of money is debited.

- Actually, Sending Money: In some cases, the scammers actually send money. The person who receives it sends it back. The scammer raises an issue with their bank to get the transaction reversed and the money is debited from your account. Essentially, the scammer receives double the amount.

How To Avoid This Scam

- Avoid Picking Up Calls From Unknown Numbers: Scammers will often call you randomly and repeatedly to catch you off guard. Having a call screening app can help you identify whether a phone number is actually genuine.

- Never Respond Immediately: Creating a sense of urgency is one of the key tactics such scammers use. When there is urgency, people tend to react quickly without much thought. Never give in to their pressure. It’s very objectively not your problem, so don’t make any hasty decisions.

- Always Check Your Bank Balance: To win your trust, scammers will send you fake payment screenshots or SMS notifications that seem convincing. Don’t believe any of these. Make sure you check your bank balance through the bank’s app or website.

- Even If You Receive Money, Don’t Send Any: In case you receive money, don’t send any back. Contact your bank and inform them of the situation. If there was a genuine mistake, they will handle it and ensure the initial transaction is reversed through due process.

When somebody claims to have sent money to the wrong account, it’s generally a scam. Even if the person shows proof, don’t believe them. Most of the time they’re lying. But in the instances where money is sent, inform your bank and let them handle it. Don’t give in to anybody’s pressure, it’s always better to be safe than sorry.

Online safety is a shared responsibility. If you found this article helpful, share it with your friends and family to help create a safer digital environment for everyone. Together, we can build a more secure internet for every generation. Click here to visit our homepage and discover more cybersecurity articles and insights.

Common Scams

Common Scams